Your Capital Advantage

Unlock working capital from your digital receivables.

We enable digital businesses to maximise financial liquidity: helping them to grow faster by converting revenue to working capital, unlocking better terms with partners and avoiding the use of equity to fund cashflow.

Your Capital Advantage

Unlock capital from your digital receivables and future revenues.

We help digital businesses increase financial liquidity by transforming receivables or future revenues into working or growth capital.

Lending financial power to digital businesses.

We support companies at all stages of the business lifecycle - from young startups all the way to large global enterprises. Our products and terms scale seamlessly and rapidly.

We work with companies with b2b receivables that operate a digital business model, and app developers.

Vane Benefits

An industry partner is better than a bank manager.

Thanks to deep industry knowledge and connectivity across the digital ecosystem we are far more than a lender. We can assess risk and reward with greater accuracy and speed than traditional financers, allowing us to extend greater quantums of credit so you can fully unleash your potential.

Vane Benefits

The advantage of non-dilution.

Non-dilutive finance allows founders to retain control and ownership. By increasing access to debt, Vane enables companies to enhance their funding mix and achieve their goals without compromise.

Vane Benefits

Finance should support growth not get in the way of it.

Our technology supports you by eliminating hurdles and accelerating processes. We finance international revenues, to give you a full global solution. We provide a solution that will cater to your needs rather than fit your needs to our offer.

Vane Benefits

An industry partner is better than a bank manager.

Thanks to deep industry knowledge and connectivity across the digital ecosystem we are far more than a lender. We can assess risk and reward with greater accuracy and speed than traditional financers, allowing us to extend greater quantums of credit so you can fully unleash your potential.

The advantage of non-dilution.

Non-dilutive finance allows founders to retain control and ownership. By increasing access to debt, Vane enables companies to enhance their funding mix and achieve their goals without compromise.

Finance should support growth not get in the way of it.

Our technology supports you by eliminating hurdles and accelerating processes. We finance international revenues, to give you a full global solution. We provide a solution that will cater to your needs rather than fit your needs to our offer.

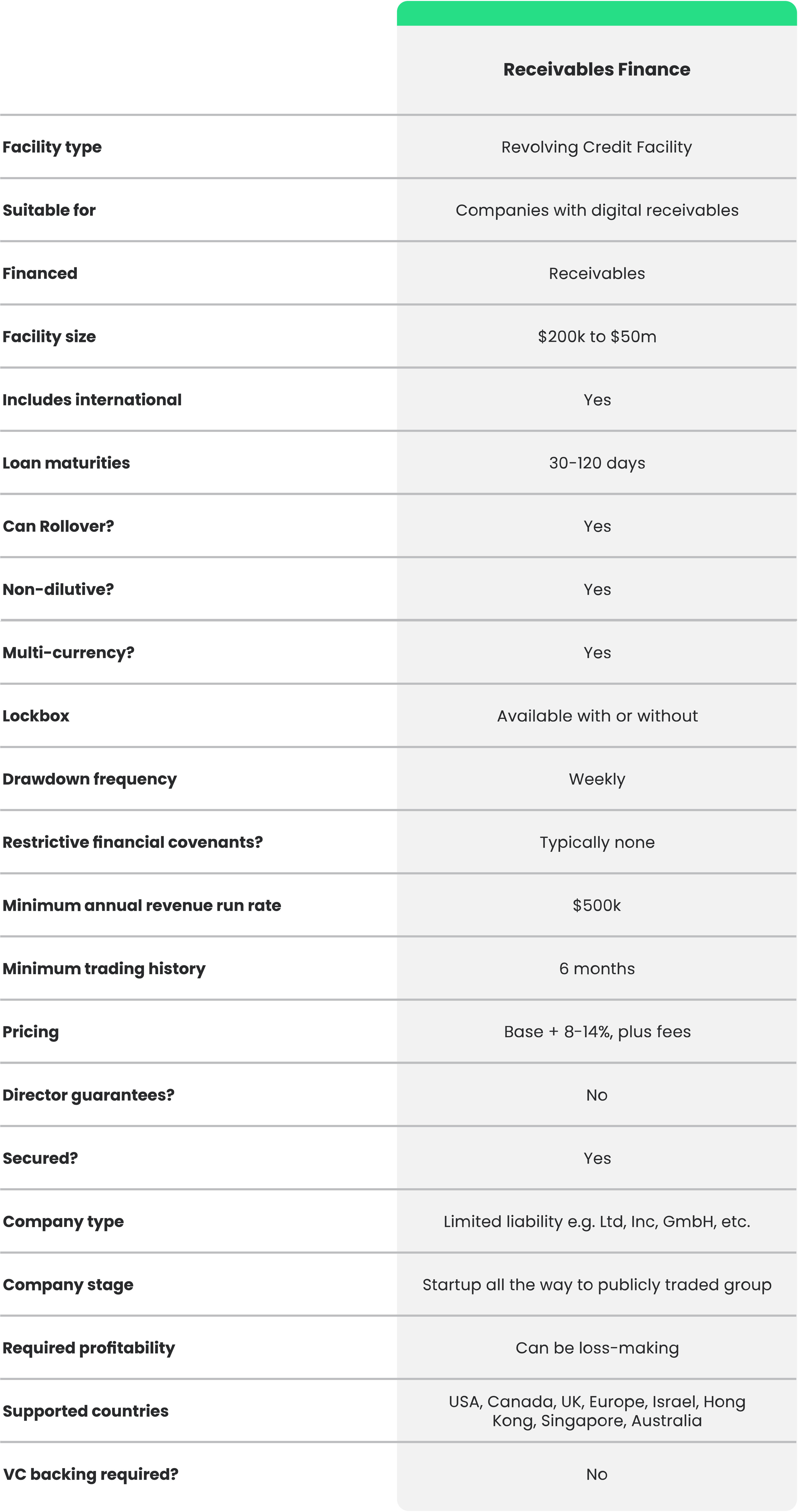

Receivables Finance

Unlock Capital

from your Digital Receivables.

Receivables Finance

1. Connect Vane to your receivables data

Syncing your accounting software, CRM, and/or other dashboards enables us to pull real-time receivables data (including accrued revenue).

Receivables Finance

2. Drawdown loan using eligible receivables from over 20 countries

We calculate your eligible receivables, including international, and show you your maximum availability.

Receivables Finance

3. Select a maturity of 30 to 120 days

Choose a drawdown maturity based on your desired flexibility and expected future receivables balance.

Receivables Finance

4. Upon maturity, choose to repay Vane or rollover loan

Repay the loan advance or pay the interest only and roll it over for another period. You can choose to increase or decrease the loan if you rollover. You can have multiple Vane drawdowns at the same time, with different maturities.

We set credit limits in line with your current and future expected receivables, giving you flexibility to drawdown what you need now, but also the option to drawdown higher amounts in the future.

What our Receivables Finance customers say

“Partnering with Vane has proven critical to our business execution”

Daniel Nguyen

CFO at TotallyAwesome

“We chose Vane because of their flexibility and commitment to be our partner, rather than just a finance provider, and help enhance our growth”

Gaston Altobelli

Head of Finance at Jampp

“Vane has been an incredibly useful and reliable partner for us during our rapid growth”

Stephane Bonjean

Co-Founder & Chairman at DynAdmic

Vane - Your Capital Advantage

AudioMob wanted a finance partner who understood its business and could support the inherent working capital challenge caused by long demand side payment terms.

Appodeal was looking for a new finance partner in 2019 to help them scale further, without the restrictions they were experiencing with their lender at the time.

Post-IPO, Fyber was seeking financing to support its growing working capital requirement as it scaled rapidly, including via multiple acquisitions of businesses in adjacent verticals; many of which would have their own working capital needs.

Facilities built for your business.

Facilities built for your business.

Experts in finance, innovators in lending, obsessed with service excellence

Get in touch to learn more about our services and how we can boost your business.

We promise to get back to you within 48 hours.

Site Map

Legal & Privacy

Get Connected

'Vane' and 'Vane Financial' are trading styles. Vane Finance Technology Limited is a company registered in England and Wales (Company No: 9446187) and is registered in the UK with the Financial Conduct Authority reference 09446187. Vane Finance Technology Inc. is registered in the State of Delaware and operates under a California Financing Law license. Our Headquarters is Vane GmbH (HBR 162057 B), registered in Berlin, Germany.

Copyright © 2021 Vane (Group). All Rights Reserved.